contra costa county sales tax increase 2020

Glazer could still derail measure Uploaded. Heres how Contra Costa Countys maximum sales tax rate of 1075 compares.

2020 General Election Endorsements Ifpte Local 21

Contra Costa County Supervisors move ahead with new half-cent sales tax measure State Senate Bill proposed by Sen.

. Please contact the local office nearest you. Measure X is a sales tax measure thats expected to generate 81 million dollars a year for the next 20 years. What is the sales tax rate in Contra Costa County.

For questions about filing extensions tax relief and more call. The California state sales tax rate is currently. Each of the Contra Costa Transportation Authoritys two recent sales-tax-increase campaigns Measure X 2016 and Measure J March 2020 was bankrolled by about 13 Million in contributions made primarily by existing and prospective vendors and contractors to the County with an odor thereby of shakedowns and anticipated kickbacks.

It was approved. 7 ConsGoods 7 FoodDrug 16 Fuel ADJUSTED FOR ECONOMIC DATA 4Q 2020 CONTRA COSTA COUNTY SALES TAX UPDATE STATEWIDE RESULTS The local one cent sales and use tax from sales occurring October through December the holiday shopping. Uninc This Quarter 27 Pools 7 Restaurants 7 AutosTrans.

This is the total of state and county sales tax rates. If it passes sales tax would increase by half a percent on most goods but not on necessities like food and medicine. Businesses impacted by the pandemic please visit our COVID-19 page.

6 ConsGoods 6 FoodDrug ADJUSTED FOR ECONOMIC DATA CONTRA COSTA COUNTY SALES TAX UPDATE TOP NON-CONFIDENTIAL BUSINESS TYPES 3Q 2020 STATEWIDE RESULTS The local one-cent sales and use tax from sales occurring July. 18 Fuel 10 Restaurants 8 Building 7 FoodDrug 7 7 AutosTrans. The December 2020 total local sales tax rate was 8250.

The Contra Costa County Board of Supervisors will proceed with pursuing a half-cent 20-year sales tax measure for Novembers general election ballot though it could be derailed if a bill now languishing in Sacramento isnt passed. It took some maneuvering in the State Senate Governance Finance Committee to get the bill to the floor for a full vote. The California state sales tax rate is currently 6.

For questions about filing. Triple Flip Unwind PDF Sales Use Tax Reference Manual PDF 2021. From april through june of this year california businesses reported a record high 2168 billion in taxable sales a 388 increase over the same period in 2020 and a 174 increase over those.

2020 Contra Costa County The unincorporated areas receipts from April through June were 280 above the second sales period in 2019 as payments deferred from earlier periods were collected. 1 The city increased its existing tax of 050 percent CNCD to 100 percent CNTU in addition to the Contra Costa countywide increase of 050 percent listed in the countywide table. Online videos and Live Webinars are available in lieu of in-person classes.

Af-ter adjusting for the payment issues and other reporting corrections ac-tual sales were up 205. 2Q 2020 Contra Costa County Sales Tax Update 0 1000 2000 3000 4000 SALES PER CAPITA Unincorporated County Q2 17 Q2 20 Q2 18 Q2 19. 1Q 2020 Contra Costa County Sales Tax Update 0 1000 2000 3000 4000 SALES PER CAPITA Unincorporated County Q1 17 Q1 20 Q1 18 Q1 19 County California Allocation aberrations have been adjusted to reflect sales activity 23 Pools 20 BusInd.

2 The city increased its existing tax of 050 percent GZGT to 100 percent GZTU and extended the expiration date to March 31 2044. The minimum combined 2020 sales tax rate for Contra Costa County California is 825. The 2018 United States Supreme Court decision in South Dakota v.

11 Building 17 BusInd. This rate includes any state county city and local sales taxes. The Contra Costa County California sales tax is 825 consisting of 600 California state sales tax and 225 Contra Costa County local sales taxesThe local sales tax consists of a 025 county sales tax and a 200 special district sales tax used to fund transportation districts local attractions etc.

Original post made on Jul 15 2020. Contra costa county sales tax increase 2020 Monday April 4 2022 Edit. The california state sales tax rate is currently.

This is the total of state and county sales tax rates. 2020 rates included for use while preparing your income tax deduction. 3 Trestle Glen Circle Tiburon Ca 94920 Tiburon Home For.

10 Building 29 BusInd. The Contra Costa County sales tax rate is. Just as Contra Costa Countys top public health official Anna Roth informed the Contra Costa County Board of Supervisors on Tuesday the number of COVID-19 positive cases has risen to 2586 cases an increase from 92 cases three weeks earlier and with 79 COVID -19 stricken patients in county hospitals up from 35 patients in county hospital.

County of Contra Costa on April 8 2020 after the March Primary election was decided and the countywide additional half-cent sales tax increase for transportation failed. Wed Jul 29 2020 1033 am 4. ConsGoods Contra Costa Co.

A county-wide sales tax rate of 025 is applicable to localities in Contra Costa County in addition to the 6 California sales tax. Contra Costa moves forward with half-cent sales tax measure for social services. That would bring Contra Costas sales-tax rate up to.

Contra costa county sales tax increase 2020 Monday April 4 2022 Edit. Uninc This Quarter 13 Fuel 24 Pools 6 Restaurants 7 AutosTrans. 2021 - Quarter 4 Not yet released 2021 - Quarter 3 Not yet released 2021 - Quarter 2 PDF 2021 - Quarter 1 PDF 2020.

The minimum combined 2022 sales tax rate for Contra Costa County California is. The Contra Costa County Sales Tax is 025. Contra costa county california sales tax rate 2021 up to 1025.

The Contra Costa County sales tax rate is 025. A onetime allocation spiked re-. However 2020 was not a normal year for processing returns.

1788 rows CDTFA public counters are now open for scheduling of in-person video or phone appointments. Contra Costa County Measure X was on the ballot as a referral in Contra Costa County on November 3 2020. He changed it to Transactions and use taxes.

A yes vote supported authorizing an additional sales tax of 05 for 20 years generating an estimated 81 million per year for essential services including the regional hospital community health centers emergency response safety-net. Some cities and local governments in Contra Costa County collect additional local sales taxes which can be as high as 45. Concord voters will consider Measure V which also would continue and increase an existing sales tax from 05 to 1.

What is the sales tax rate in Contra Costa County. The latest sales tax rate for Contra Costa County CA. Djn0e3qka T0wm Director Of Human Resources Src Hingemarketing Com Customer Persona Persona Human Resources.

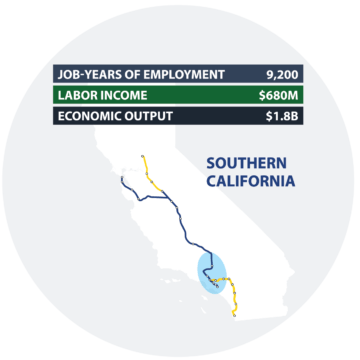

Economic Investment California High Speed Rail

California Housing Market Forecast 2022 Forecast For Home Prices Sales Managecasa

California Housing Market Forecast 2022 Forecast For Home Prices Sales Managecasa

California Housing Market Forecast 2022 Forecast For Home Prices Sales Managecasa

Election 2020 Contra Costa County Local News Matters

Economic Investment California High Speed Rail

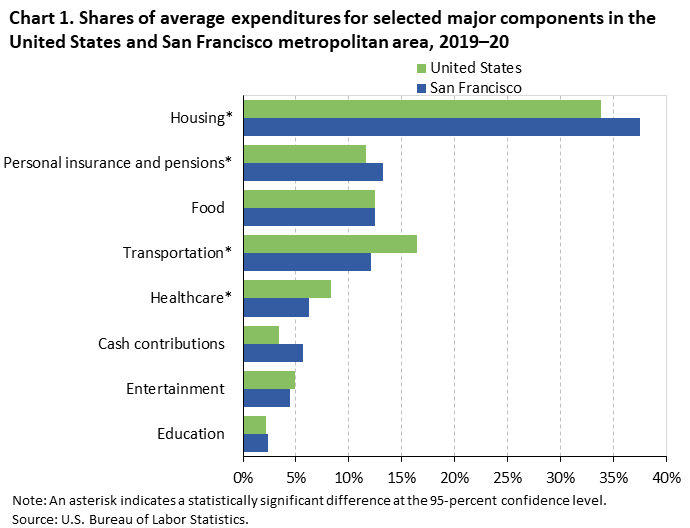

Consumer Expenditures For The San Francisco Metropolitan Area 2019 20 Western Information Office U S Bureau Of Labor Statistics

Supervisors Respond To Jury Report Critical Of Contra Costa Animal Services Local News Matters